In 2017, at the request of the G20, the Financial Stability Board (FSB), an international organization that pursues the efficiency and stability of the international financial system, created the Task Force on Climate related Financial Disclosure (TCFD), a working group led by Michael Bloomberg, former Mayor of New York and founder of Bloomberg, the world’s largest financial information company, particularly for institutional investors. TCFD’s purpose is to provide investors, lenders and insurers with reliable information on the management of climate-related risks and opportunities so that they can make assertive decisions.

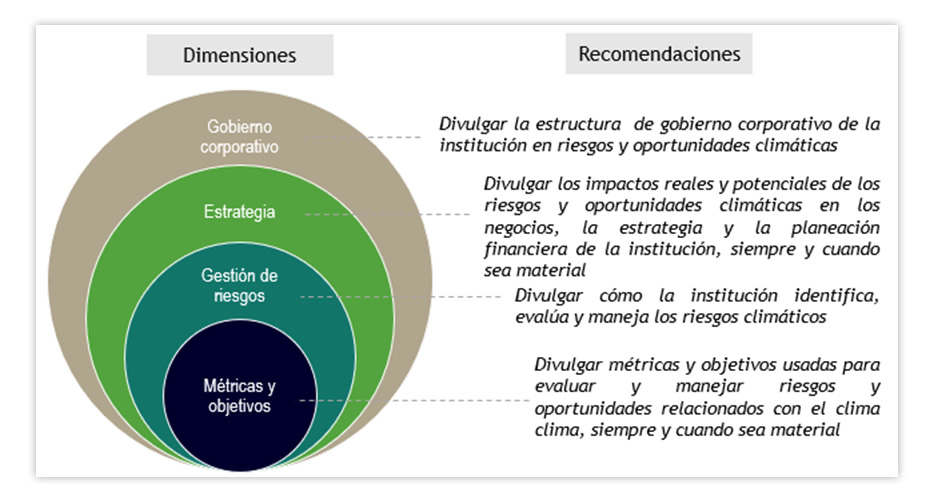

Within this framework, global regulations have been increased for the management of risks and opportunities related to Climate Change and its reporting in management reports.The TCFD recommendations are divided into four dimensions (or thematic areas), which provide feedback and are based on the effective management of Climate Governance by the highest management in the identification, strategy, management, monitoring and metrics related to opportunities and weather-related risks.

“This means that the investment community will focus its capital on the companies and industries that are best prepared to address those climate risks and opportunities"

According to the latest TCFD report Between 2017 and 2019, climate change generated global economic losses worth 640,000 million dollars, according to this report, by the end of the century, disasters derived from global warming and its consequences will put assets at risk worth more than 43 billion dollars.

What concrete actions should your company take to manage climate risks and opportunities?

1. Identification of physical risks.

- Analysis of changes in weather patterns (climate variability and frequency, duration, and intensity of extreme events) that cause climate-related threats (sea level rise, droughts, floods, landslides, heat waves, fires forestry, among others) its impact and prospects for 2030, 2050 and 2100 in the country, sector and the main regions where the Company operates.

- Preparation of the initial inventory of physical risks related to climate change.

- Definition of scenarios (including a 2 °C scenario) establishing the “base case” with respect to which the comparison will be based and the possible impact will be estimated.

2. Climate Risk Measurement:

- Analysis of causes and consequences for each type of threat identified and its zoning.

- Analysis of correlations between physical risks.

- Heat map of physical risks to visualize the criticality of threats based on criteria of high, medium and low importance.

- Estimate of the company’s sensitivity to each risk and variable, as well as the associated impact in three dimensions: people, operations (activities and processes, and physical infrastructure.

3. Identification of transition risks:

- Identification of political and legal, technological, market and reputation risks according to scenario analysis.

- Analysis of causes and consequences for each type of threat identified and its zoning.

- Analysis of correlations between transition risks.

- Heat map of transition risks to visualize the criticality of threats based on criteria of high, medium and low importance.

4. Economic quantification of the impacts:

- Estimation of the economic impact of physical risks.

- Analysis of the CO2 price associated with each climate scenario and estimate of the economic impact of transition risks.

5. Analysis of Opportunities derived from Climate Change:

- Market Analysis.

- Benchmark of the sector to identify opportunities identified in the business.

- Analysis and listing of opportunities related to the climate for the business.

6. Resilience Plan

- Resilience plan where the intervention actions are enunciated, in view of the findings under three approaches:

- Reducing the threat.

- Reduction of vulnerability.

- Adaptation to climate change.

- Consolidation of the Resilience Plan in Saggio, a tool that allows strategic control with an alert system.